Forex swing trading is an essential strategy for many traders seeking to capitalize on market fluctuations. Trading in the Forex market can be lucrative, but it requires a strategic approach to align with emerging trends and potential profit opportunities. In this article, we’re going to explore effective Forex swing trading strategies that can enhance your trading skills and boost your profits, along with key aspects such as risk management, technical analysis, and the importance of trading platforms like forex swing trading strategies Pakistani Trading Platforms.

Understanding Swing Trading

Swing trading is a medium-term trading strategy that involves holding positions for several days to capture price movements. Unlike day trading, where trades are opened and closed within the same day, swing trading allows traders to take advantage of price swings that can occur over a longer period. This approach requires patience and the ability to analyze market trends effectively.

The Advantages of Swing Trading

Choosing swing trading offers several advantages:

- Flexibility: Swing trading does not require constant monitoring of the markets, allowing traders to maintain a balanced lifestyle.

- Less Stressful: Compared to day trading, swing trading is less stressful as it provides more time for analysis and decision-making.

- Opportunity for Higher Gains: By holding onto trades longer, swing traders can take advantage of larger market moves.

Key Strategies for Forex Swing Trading

Implementing a successful swing trading strategy involves understanding various methods, including technical analysis tools, chart patterns, and market indicators. Below are some key strategies that can help you improve your swing trading results:

1. Trend Following

One of the simplest swing trading strategies is to follow the prevailing trend. Traders can use technical indicators such as moving averages to determine the direction of the market. For instance, if the price is above the moving average, traders should consider buying, while selling or shorting should be on the agenda if the price is below the moving average.

2. Breakout Trading

Breakouts occur when the price moves above a key resistance level or below a key support level. When this happens, momentum often increases, providing a potential opportunity for swing traders. Traders can place buy orders just above resistance levels or sell orders just below support levels to capitalize on breakout potential.

3. Retracement Trading

Retracements offer excellent opportunities to enter trades during a trend. After a significant price movement, it’s common for the price to correct temporarily. Traders can use Fibonacci retracement levels to identify potential reversal points where they can enter the market in the direction of the trend.

4. Using Chart Patterns

Chart patterns, such as head and shoulders, triangles, and flags, are important indicators for swing traders. Identifying these patterns can lead to better entry and exit points. For instance, confirming a head and shoulders pattern can provide an opportunity to enter a short position as the price is likely to reverse its course.

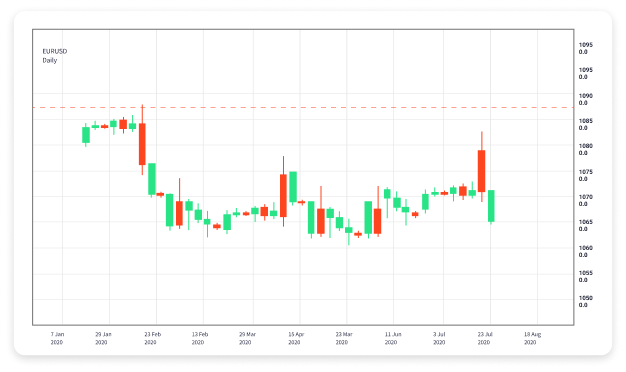

5. Candlestick Patterns

Candlestick patterns deliver valuable insights about market sentiment and potential price reversals. Familiarizing yourself with various patterns like doji, engulfing, and hammer candles can improve your ability to identify trade setups. Candlestick patterns can often signal when to enter a trade or when to exit.

Risk Management in Swing Trading

Effective risk management is critical in trading, especially in Forex. Here are some key principles to implement:

- Set Stop-Loss Orders: Always ensure to set stop-loss orders to minimize potential losses on trades.

- Risk-Reward Ratio: Aim for a risk-reward ratio of at least 1:2 or higher, allowing for a greater return on successful trades compared to potential losses.

- Diversification: Avoid putting all your capital into a single trade; diversify your trading portfolio to mitigate risks.

- Position Sizing: Calculate the appropriate position size based on your account balance and risk tolerance to avoid overexposure.

Choosing the Right Trading Platform

Your trading platform plays an essential role in your swing trading journey. It’s crucial to select a reliable and efficient platform that provides the necessary tools and data for analysis. Features to look for include:

- User-Friendly Interface: The platform should be easy to navigate, especially for beginners.

- Real-Time Data: Access to real-time market data can enhance decision-making and trading effectiveness.

- Research Tools: Look for platforms that offer robust research and analytical tools to aid your trading strategies, including charting tools and market indicators.

- Customer Support: Reliable customer support is essential, especially for new traders who might need assistance.

In Conclusion

Forex swing trading presents a viable strategy for traders looking to profit from market fluctuations of varying lengths. By following proven strategies and implementing effective risk management, traders can enhance their chances of success. Don’t forget that the choice of trading platform, such as the available Pakistani Trading Platforms, is also a critical factor in your trading success.

As you enter the world of swing trading, remember that consistency is key. Practice your strategies, stay informed on market trends, and refine your approach as you gain experience. Happy trading!